My old roommate and good friend Ryan Majeau and I often debate, about pretty much everything (we’re both stubborn). One time we got into an argument (debate) about whether it was more expensive to buy your lunch out everyday or spend the time to make a bag lunch. His argument was always for eating out. He figured by the time he bought bread, lunch meat, cheese, and veggies to make a sandwich, then added a granola bar and maybe an apple he was easily up over $5. “For that price you might as well just save yourself the trouble, go spend $5 on lunch and skip the hassle.” he argued.

As I sat there with my soggy homemade sandwich from my bag lunch looking over at him with his fresh $5 footlong sub I found it quite hard to argue with him at that point.

Fast forward to today. I’m living off of $8 a day and there’s no way in hell I can justify spending $5 on a lunch. So, it was time to rethink the theory.

‘Maybe the imbalance wasn’t bag vs bought lunch but rather strategic spending over poor planning.’ I thought.

Best Bang for the Budget Buck

To date I had already spent $156 of my $250 budget and had bought enough food to hopefully last me most of the month. Last week, when I went shopping with Dave we were very strategic on the deals that we chose making sure to maximized every dollar. Unfortunately when I started cooking I realized a small problem, I hadn’t thought at all about the meals I was going to make with my cheap food.

What recipes was I going to make all month? What ingredients was I going to use in each meal? And how much could I afford to use?

I originally planned to only spend $1 on breakfast, $2 on lunch and $5 on dinner but the problem was I had no idea how much the meals I was making were actually costing me or how I was going to make them for as little as $2!

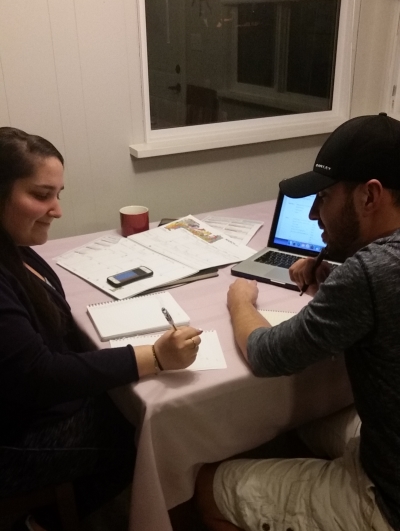

I was lost and if I didn’t figure something out soon I knew I was going to run out of food and be in serious trouble before the end of the month. So I called the most organized person I know, my friend Molly.

Molly and I had met in college at a student volunteer organization called Enactus and although she was years younger than most of us, she very rapidly adopted the roll of mom on the team.

When I sat down with Molly to discuss her budget techniques she was more than prepared.

Plan, Portion & Plate

Molly was meticulous in organizing and executing her own personal budget. She was a planning pro!

Molly and her fiancée Jesse had an aggressive plan to pay off their mountainous school debt and save for their wedding in the fall. Although neither of them had extremely high paying jobs they were somehow putting away over $1000 a month towards their debt and $800 a month towards their wedding.

How the hell were they regularly saving more money than me on $1000’s less per year?

Molly explained her secret: Planning, planning & more planning

Every month she would go through and outline exactly how much money they were going to be making. She would assign every penny to a certain cost. $320 on gas, $400 on food, $75 spending money; she knew where all of it went and by the end she knew she had enough to survive and exactly how much she was going to put towards her goals.

I had never seen anything like this. I mean I have a budget but like most people I go over it every month and wonder why I’m not able to save money or pay anything off.

Molly then showed me her meal plan system. For two weeks she would outline every meal her and Jesse would be eating for breakfast, lunch and dinner. She knew what ingredients were in each meal, the portion sizes and a cost breakdown so she knew she would always be under her budget.

Planning for Dummies 2.0

I was obviously needing another lesson in meal planning. Meal planning with my Plan to Eat app last month saved me from both chaotic last minute shopping and late night dinner burnouts but this month I not only needed to plan what I was eating, I needed to strategically plan my meals on how much they would cost me to make…

Over the next couple hours Molly and I planned out every single meal for everyday I had left in my month. We went over all the food I had already bought and even sifted through this weeks flyers to find deals on some stuff I was missing. She even took me over to the grocery store where I dropped another $51.44.

At the end of the night I left with a full meal plan for every single day of my month; I knew exactly what I was eating for Breakfast, Lunch, and Dinner and by breaking down each ingredient into portion sizes I knew exactly how much each meal was going to cost me. All of a sudden I had a new outlook on my month. My stress level subsided and I got a sense I could actually make it the rest of the way through.

Beating Budgeting And Old Friends

Here’s what I learned:

- Budgeting isn’t just about buying the cheapest stuff. You can shop as smart as you want but if you buy the wrong stuff you can blow your whole budget.

- Plan your meals before you do your shopping. This will save you from buying stuff you don’t need and by pricing out your ingredients in advance you’ll know if it’s too expensive to make and if you need to meal find a cheaper alternative.

- Breakfast and lunch doesn’t have to be your cheapest meal of the day. If you shop smart and plan well you can actually eat a really great dinner for cheap leaving you the option to eat a nicer breakfast and stretch your leftovers into lunch.

With this last point in mind I had shifted my whole budget. Now I was eating dinners for easily less than $5 (sometimes as cheap as $1.60) and with this new found wealth I could now redistribute some of my budget to other meals. For example, instead of a simple (boring) two eggs breakfast every morning I could make omelettes or smoothies. Instead of boxes of KD or Mr. Noodles for lunch I could now just double up my dinner servings and eat really delicious and healthy (somewhat) leftovers for lunch. Life on $8 per day just got a lot sweeter!

Now I don’t want to say my friend Majeau was wrong cause ‘technically’ his take-out lunches were cheaper (and way better) than my soggy sandwiches but for $3 I’ll take my homemade Pulled Pork and Fries or Chicken Chow Mein any day!